2024 Schedule A Form 1040 Schedule

2024 Schedule A Form 1040 Schedule. This schedule is used by. Understanding the multitude of tax forms can be a challenging task, even for seasoned taxpayers. Check out the new guidelines and.

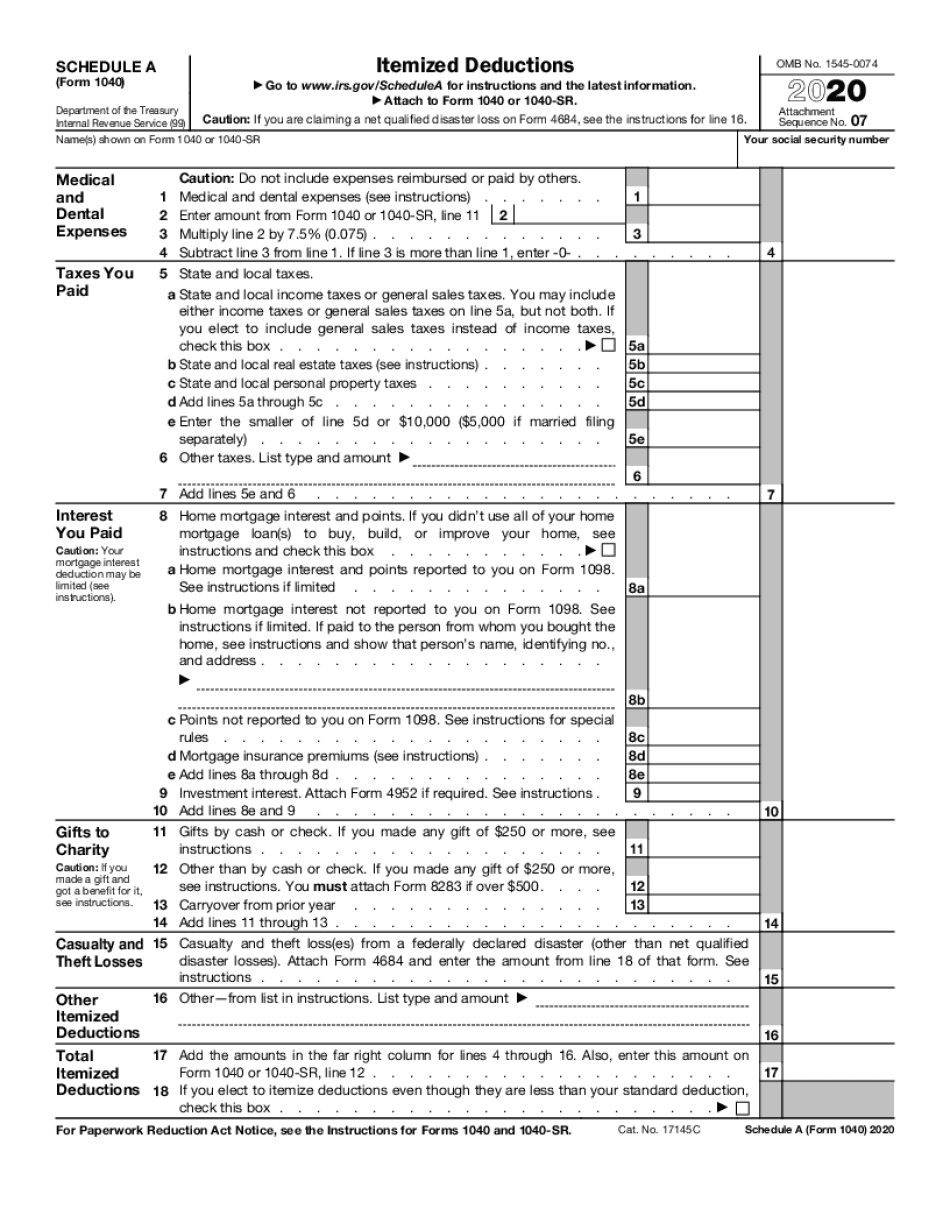

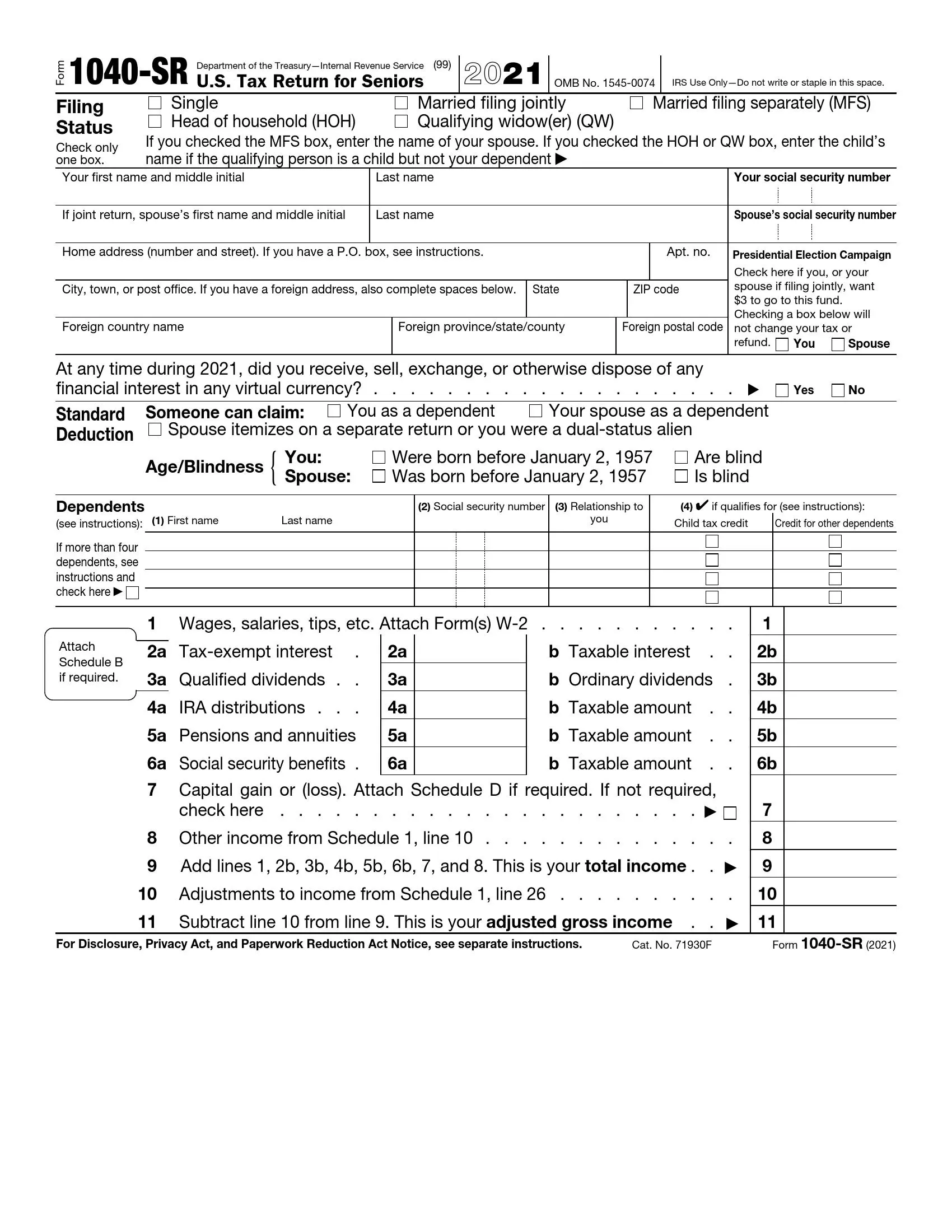

Information about schedule a (form 1040), itemized deductions, including recent updates, related forms, and instructions on how to file. Another way the irs has been collecting crypto data is via a question about digital assets on the front page of individual tax returns.

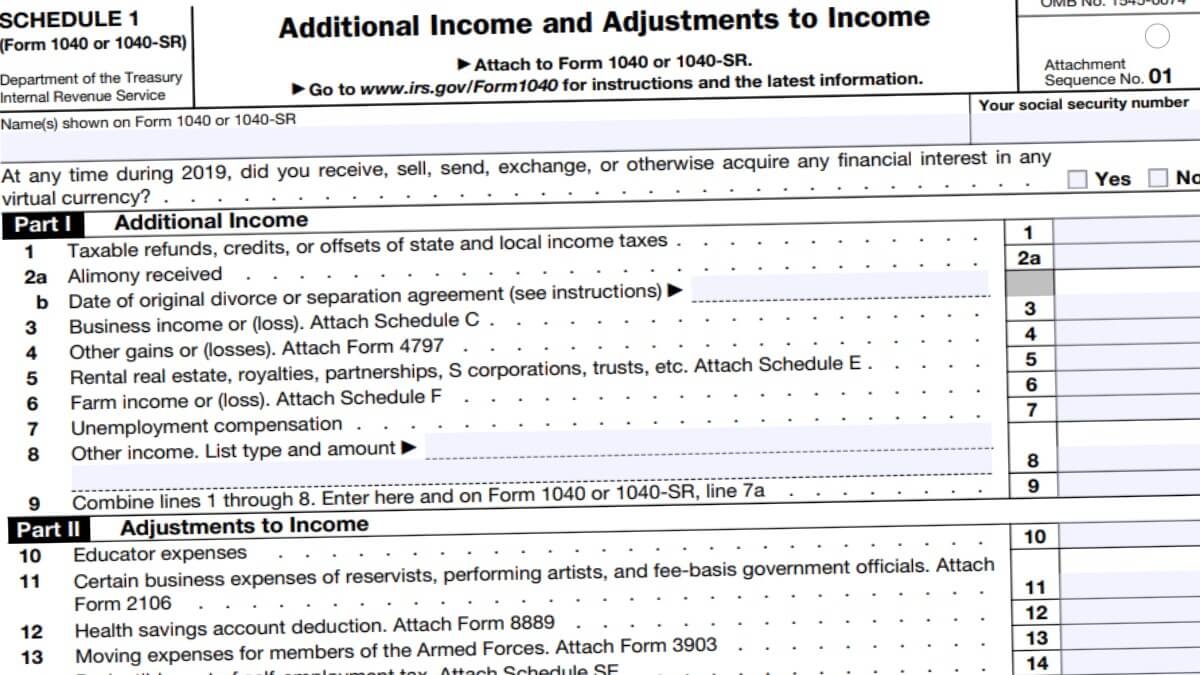

Schedule 1 Is A Tax Form That You Need To Attach To Your Federal Tax Return — Irs Form 1040 — If You Have Certain Types Of Income Or If You Have Certain Expenses.

This schedule is used by.

Understanding The Multitude Of Tax Forms Can Be A Challenging Task, Even For Seasoned Taxpayers.

Schedule a is an optional schedule of form.

Images References :

Source: edit-document.com

Source: edit-document.com

Edit Document Schedule A Form 1040 According To Your Needs, The deadline this tax season for filing form 1040, u.s. Another way the irs has been collecting crypto data is via a question about digital assets on the front page of individual tax returns.

Source: www.sfa.msstate.edu

Source: www.sfa.msstate.edu

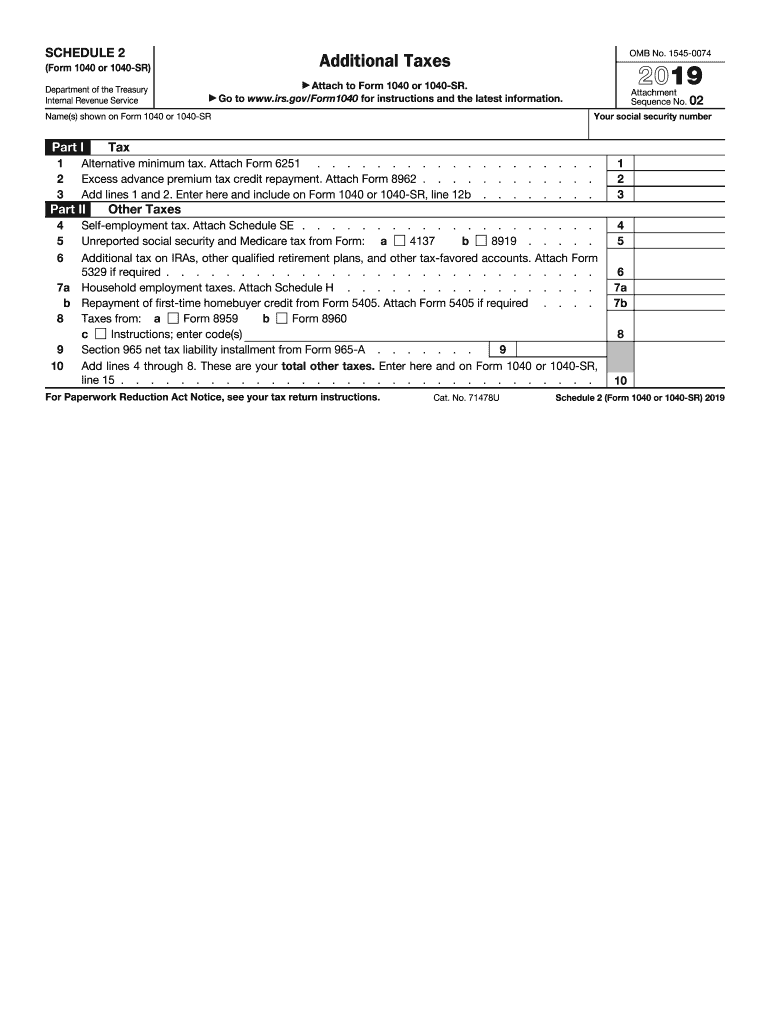

Do you need to submit a schedule 1, 2, and 3 along with your 1040 Tax, This article delves into the complexities of irs form 1040 schedule b, a crucial component for reporting interest and ordinary dividends on your tax return. Your comprehensive guide for irs schedule 2 additional taxes on page 1 of the individual income tax return.

Source: letiziawminta.pages.dev

Source: letiziawminta.pages.dev

2024 Form 1040 Schedule 2 Instructions Schedule Carri Cristin, Final versions of the quarterly federal. Go to www.irs.gov/schedulea for instructions and the latest information.

Source: www.taxuni.com

Source: www.taxuni.com

1040 Schedule 1 2023 2024, Itemized deductions is an internal revenue service (irs) form for u.s. Itemized deductions as a stand alone tax form calculator to quickly calculate specific amounts for.

:max_bytes(150000):strip_icc()/1040-SR-TaxReturnforSeniors-1-ccfefd6fef7b4798a50037db30a91193.png) Source: www.investirsorcier.com

Source: www.investirsorcier.com

Formulaire 1040SR les personnes âgées reçoivent un nouveau, The revision is planned to be used for all four quarters. The deadline this tax season for filing form 1040, u.s.

Source: www.templateroller.com

Source: www.templateroller.com

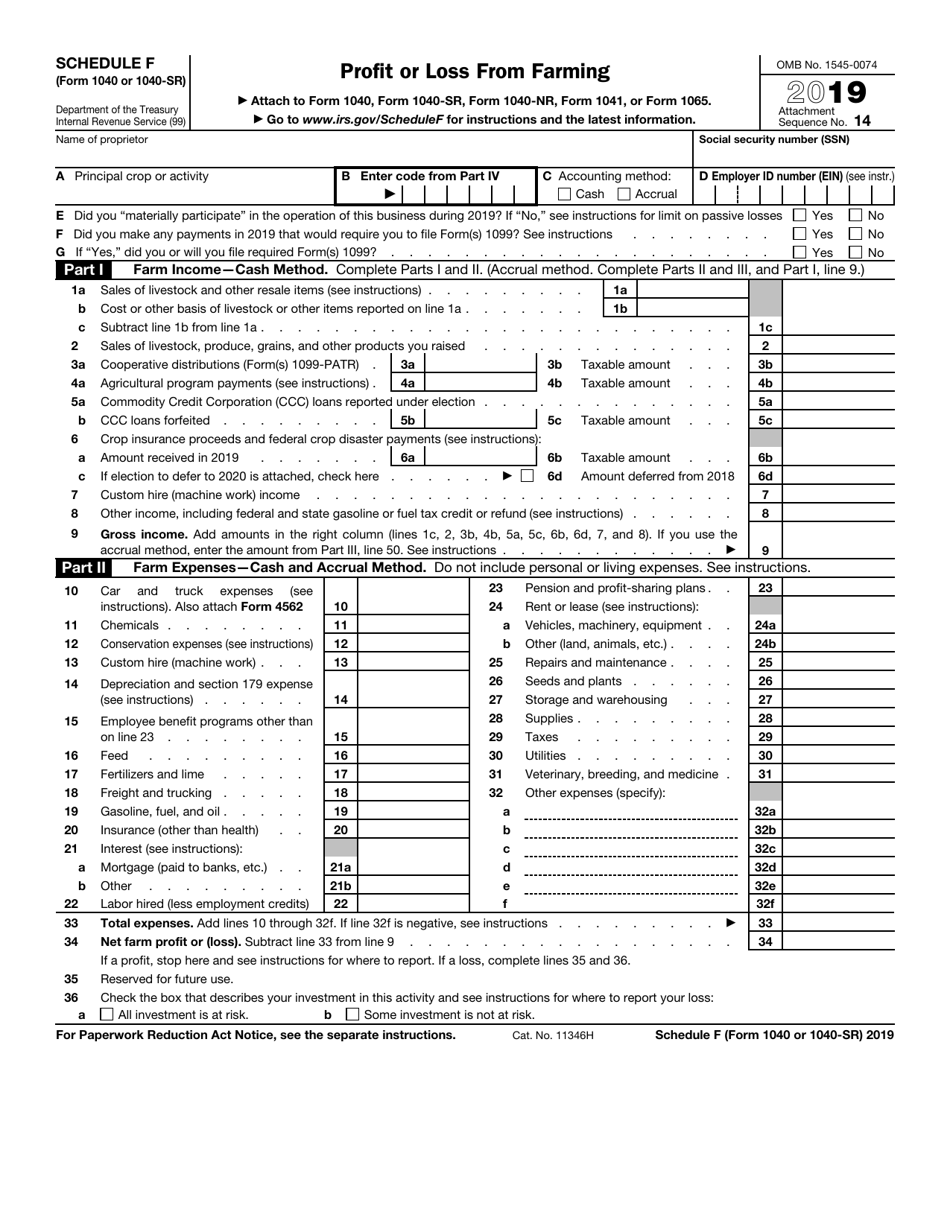

IRS Form 1040 (1040SR) Schedule F 2019 Fill Out, Sign Online and, It provides details and numerical amounts for each of the deductions you’re claiming to. Here are some major irs tax forms, schedules and publications.

Source: printableformsfree.com

Source: printableformsfree.com

1040 Sr Tax Form 2023 Printable Forms Free Online, Here are some major irs tax forms, schedules and publications. Among these forms, irs form 1040 schedule 2 often stands out.

Source: www.turneraccountancy.com

Source: www.turneraccountancy.com

What Your Itemized Deductions On Schedule A Will Look Like After Tax Reform, 2024 irs tax form 1040 schedule d capital gains and losses: What is schedule a of irs form 1040?

Source: seasonschedule.blogspot.com

Source: seasonschedule.blogspot.com

1040 Form 2022 Schedule C Season Schedule 2022, Key irs tax forms, schedules and publications for 2024. What is schedule a of irs form 1040?

Source: www.signnow.com

Source: www.signnow.com

Irs Schedule 2 20192024 Form Fill Out and Sign Printable PDF, Itemized deductions is an internal revenue service (irs) form for u.s. A guide to the itemized deduction.

Check Out The New Guidelines And.

Department of the treasury internal revenue service.

For Instructions And The Latest Information.

Another way the irs has been collecting crypto data is via a question about digital assets on the front page of individual tax returns.