Medicare Income Tax Limits 2024

Medicare Income Tax Limits 2024. This transmittal updates extra help resource and income limits and provides new policy to support legislative changes mandated in the inflation. The 2024 medicare income limit is $103,000 for individuals and $206,000 for couples.

Both houses of congress received this final rule on april 4, 2024. Can i pay more for medicare part b premiums in 2024 based on my income?

Monthly Medicare Premiums For 2024.

Refer to what's new in publication 15 for the current wage limit for social security wages.

Below Is A Breakdown Of The Medicare Extra Help Income And Asset Limits For 2024.

What you’ll pay in 2024.

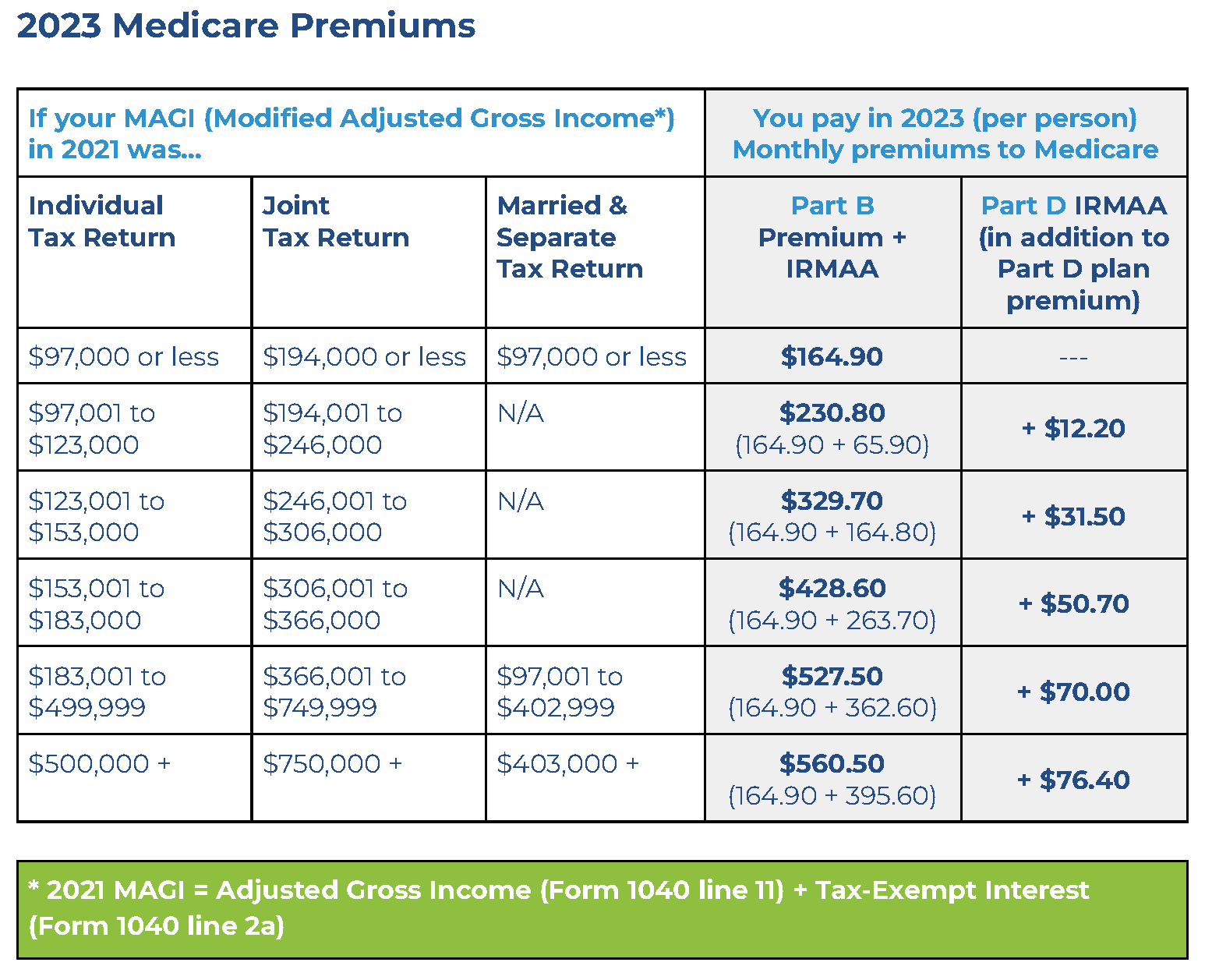

In 2024, That Standard Part B Premium Sits At $174.70.

Images References :

Source: elizaqjuliana.pages.dev

Source: elizaqjuliana.pages.dev

Medicare Premiums Limits 2024 Twila Ingeberg, For earnings in 2024, this base is $168,600. The income limit for 2024 is $103,000 for individuals and $206,000 for couples, based on their 2022 tax return.

.png) Source: celestawvalli.pages.dev

Source: celestawvalli.pages.dev

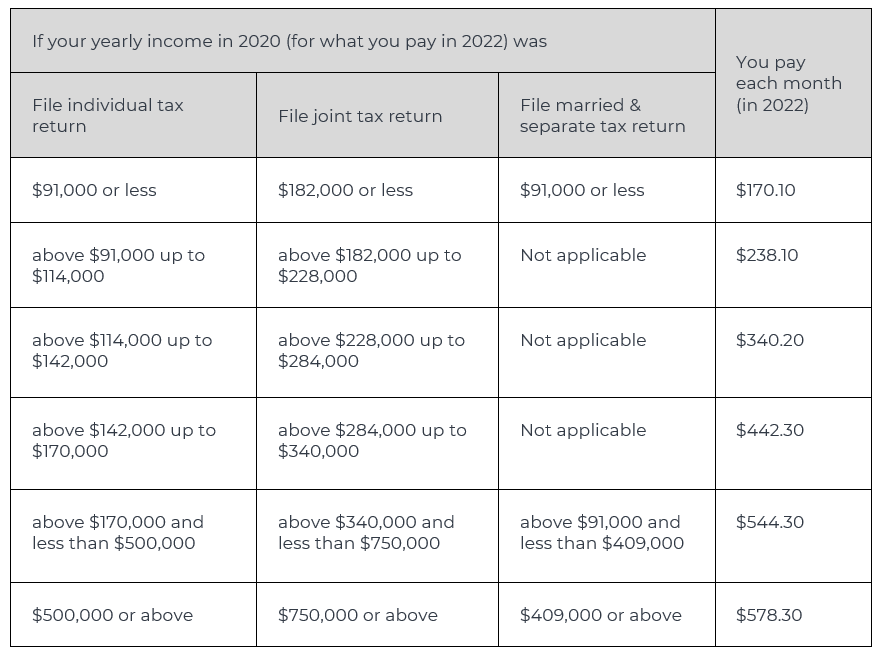

Medicare Tax Limits 2024 Jodi Rosene, In figuring the premiums of beneficiaries for 2024, medicare uses tax returns from 2022, which is the most recent year the irs provides to social security. You are eligible for medicare when you turn 65 or have a qualifying disability.

Source: devondrawletty.pages.dev

Source: devondrawletty.pages.dev

How Much Are Medicare Premiums In 2024 Lotti Rhianon, There is no maximum wage limit for the. Can i pay more for medicare part b premiums in 2024 based on my income?

Source: isadorawivett.pages.dev

Source: isadorawivett.pages.dev

Affordable Health Care Limits 2024 Devin Feodora, Refer to what's new in publication 15 for the current wage limit for social security wages. Like social security tax, medicare tax is withheld from an.

Source: gayleqannetta.pages.dev

Source: gayleqannetta.pages.dev

Medicare High Tax 2024 Lily Shelbi, The estimated average payment will go up by $59, to $1,907 from $1,848. Monthly medicare premiums for 2024.

Source: www.calpronetwork.com

Source: www.calpronetwork.com

Medicare Premium Limits — CALPRO, The 2024 medicare income limit is $103,000 for individuals and $206,000 for couples. In figuring the premiums of beneficiaries for 2024, medicare uses tax returns from 2022, which is the most recent year the irs provides to social security.

Source: www.senior-advisors.com

Source: www.senior-advisors.com

Medicare Blog Moorestown, Cranford NJ, For 2024, beneficiaries whose 2022 income exceeded $103,000 (individual return) or $206,000 (joint return) will pay a total premium amount ranging from $244.60. Depending on your income, you may pay higher premiums for medicare part b.

Source: traceewdahlia.pages.dev

Source: traceewdahlia.pages.dev

Medicare Premiums For High Earners 2024 Terra, In figuring the premiums of beneficiaries for 2024, medicare uses tax returns from 2022, which is the most recent year the irs provides to social security. What is the medicare irmaa for 2024, and when does it apply?

Source: gayleqannetta.pages.dev

Source: gayleqannetta.pages.dev

Medicare High Tax 2024 Lily Shelbi, For 2024, beneficiaries whose 2022 income exceeded $103,000 (individual return) or $206,000 (joint return) will pay a total premium amount ranging from $244.60. According to their 2022 tax returns, the maximum income for individuals and couples for medicare in 2024 is $103,000 for.

Source: allynqnoelle.pages.dev

Source: allynqnoelle.pages.dev

2024 Medicare Limits Faunie Maurita, For earnings in 2024, this base is $168,600. Below is a breakdown of the medicare extra help income and asset limits for 2024.

For Earnings In 2024, This Base Is $168,600.

There is no income limit for medicare.

You’re Responsible For Paying Half Of This Total Medicare Tax Amount (1.45%) And Your Employer Is Responsible.

In 2024, that standard part b premium sits at $174.70.