Tennessee Sales Tax Rate Changes 2024

Tennessee Sales Tax Rate Changes 2024. Tax rates are provided by avalara and updated monthly. The sales tax is comprised of two parts, a state.

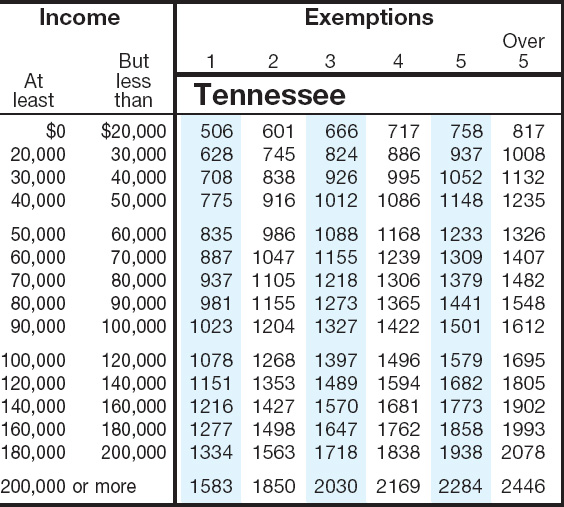

What is the tax rate range for tennessee? Please refer to the following.

Bill Lee Will Propose Changes To The State's Franchise Tax During The Upcoming Legislative Session To Offer Tax Relief To Businesses.

What is the tax rate range for tennessee?

Look Up 2024 Sales Tax Rates For Nashville, Tennessee, And Surrounding Areas.

Every 2024 combined rates mentioned above are the results of tennessee state rate (7%), the county rate (0% to 2.75%), the tennessee cities rate (0% to 2.75%).

The Streamlined Sales And Use Tax Project Is A National Effort By States To Simplify And Modernize Administration Of State And Local Sales And Use Tax Laws.

Images References :

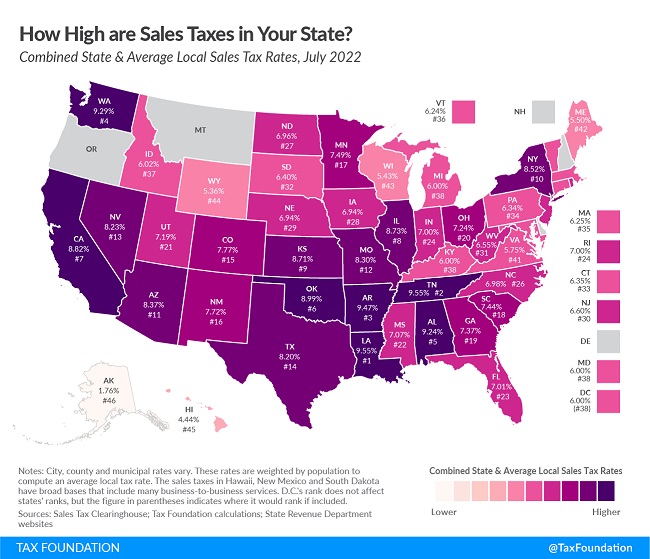

Source: taxfoundation.org

Source: taxfoundation.org

2022 Sales Tax Rates State & Local Sales Tax by State Tax Foundation, The sales tax is tennessee’s principal source of state tax revenue accounting for approximately 60% of all tax collections. Tax rates are provided by avalara and updated monthly.

Source: www.newtaxdeductions.com

Source: www.newtaxdeductions.com

The latest changes in the tax law that will effect you. New Tax, The streamlined sales and use tax project is a national effort by states to simplify and modernize administration of state and local sales and use tax laws. Bill lee will propose changes to the state's franchise tax during the upcoming legislative session to offer tax relief to businesses.

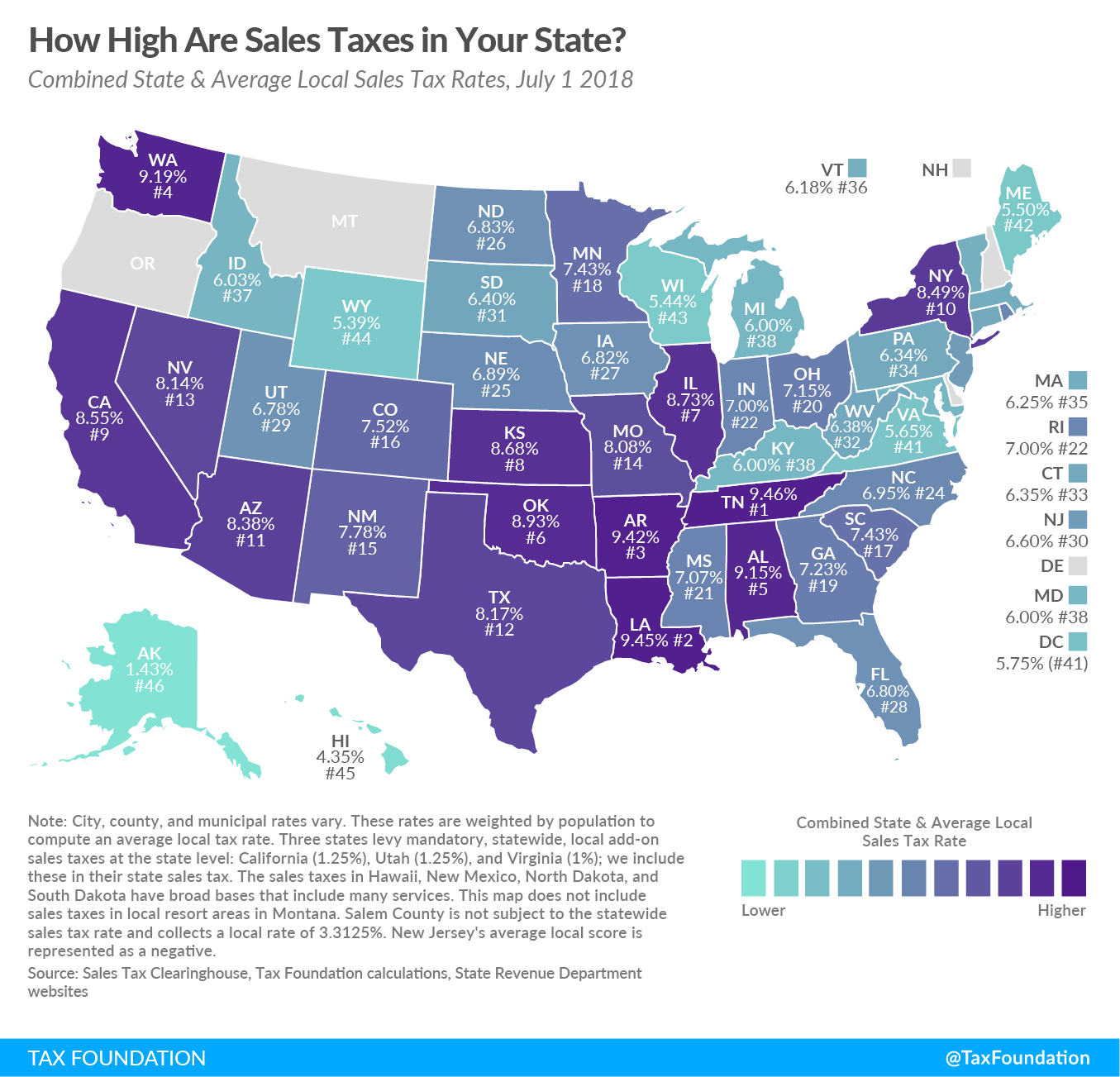

Source: wisevoter.com

Source: wisevoter.com

Sales Tax by State 2023 Wisevoter, Look up 2024 sales tax rates for shelbyville, tennessee, and surrounding areas. The sales tax is tennessee’s principal source of state tax revenue accounting for approximately 60% of all tax collections.

Jenniffer Comstock, The tennessee sales tax rate is 7% as of 2024, with some cities and counties adding a local sales tax on top of the tn state sales tax. Use our calculator to determine your exact sales tax rate.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, 1, 2024, instituting a sales tax on repair and installation services conducted on property located outside the state, when the ultimate destination of. 2024 tennessee sales tax changes over the past year, there have been four local sales tax rate changes in tennessee.

Source: pbn.com

Source: pbn.com

Tax Foundation R.I. state sales tax second highest in country, Exemptions to the tennessee sales tax. 1, 2024, instituting a sales tax on repair and installation services conducted on property located outside the state, when the ultimate destination of.

Source: www.salestaxhandbook.com

Source: www.salestaxhandbook.com

Tennessee Sales Tax Calculator, The sales tax is tennessee’s principal source of state tax revenue accounting for approximately 60% of all tax collections. Below, we will highlight some of the basic provisions of tennessee sales tax law.

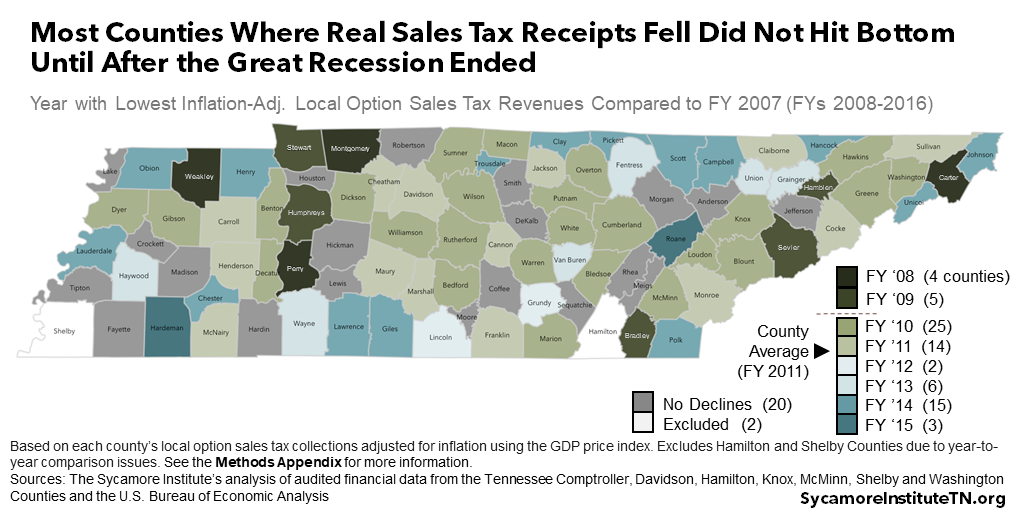

Source: www.sycamoreinstitutetn.org

Source: www.sycamoreinstitutetn.org

Which Tennessee Counties Might See the Largest Drop in Sales Tax Revenue?, What is the tax rate range for tennessee? Additional changes to sales tax changes will take effect on jan.

Source: www.pinterest.com

Source: www.pinterest.com

Sales Tax by State Here’s How Much You’re Really Paying Sales tax, The tennessee sales tax rate is 7% as of 2024, with some cities and counties adding a local sales tax on top of the tn state sales tax. What is the tax rate range for tennessee?

Source: www.nashvillescene.com

Source: www.nashvillescene.com

Tennessee Now Has the Highest Sales Tax in the Country Pith in the, Use our calculator to determine your exact sales tax rate. Tennessee sales & use tax rates change all the time and they differ depending on location too.

This Page Lists An Outline Of The Sales Tax Rates In Tennessee.

The tennessee sales tax rate is 7% as of 2024, with some cities and counties adding a local sales tax on top of the tn state sales tax.

Additional Changes To Sales Tax Changes Will Take Effect On Jan.

The sales tax is comprised of two parts, a state.